Inflation By Any Other Name

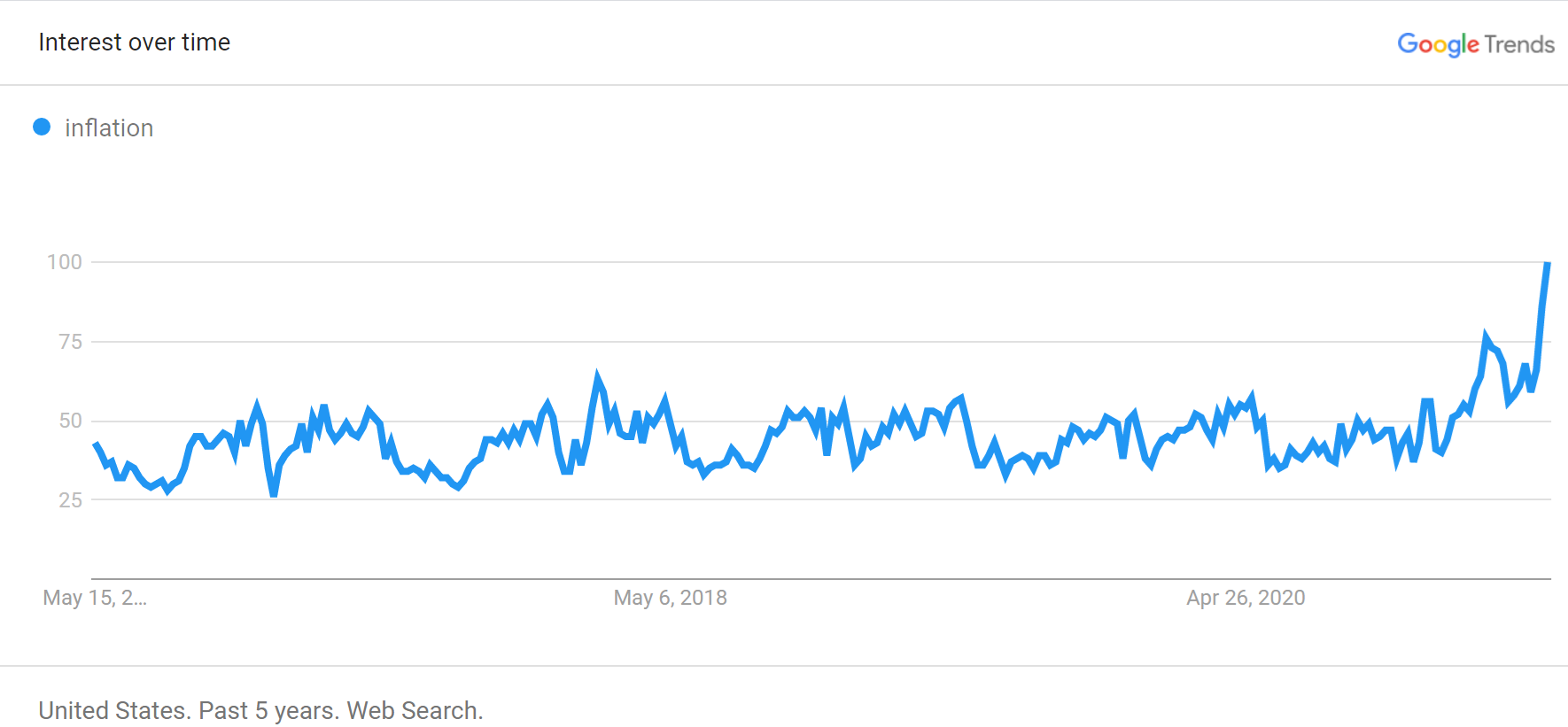

Last week, the U.S. Labor Department released the Consumer Price Index (CPI) figures for April. Based on the inordinate amount of news it triggered, you’d be hard pressed to find someone not talking about it. Just look at the Google Trends chart below that highlights the surge in searches for “inflation.”

Google Trends (Interest Over Time) for “Inflation”

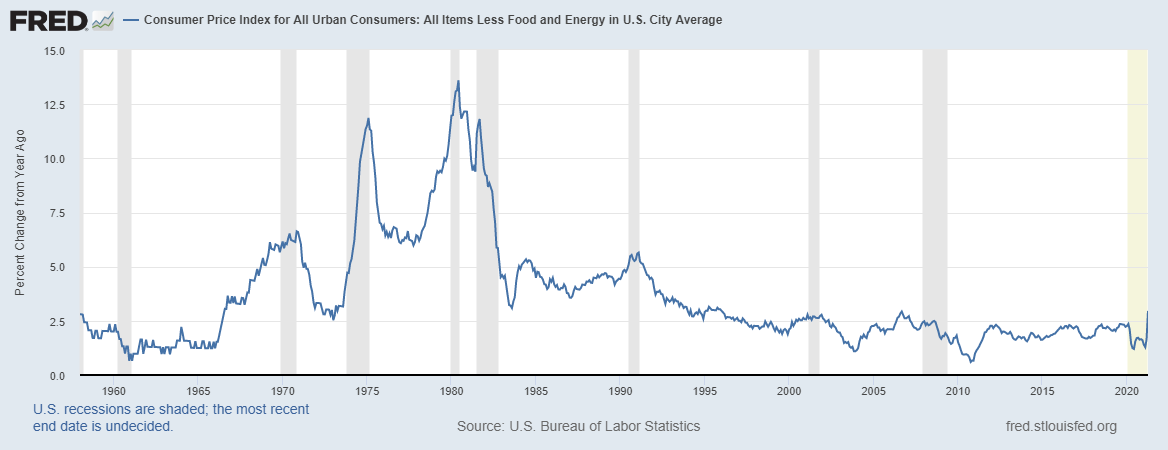

To sum April’s CPI results, inflation accelerated at its fastest pace in more than 12 years. Headline CPI rose 4.2% year-over-year (the market expected +3.6%), and it was up 0.8% from March. Excluding food and energy, which are more prone to short-term swings, “core” CPI was 3% higher than April 2020, and 0.9% higher than March 2021. The year-over-year increase in headline CPI was the fastest since September 2008, while the core inflation gain was the largest since January 1996!

Core CPI – Annual Change

Part of the explanation is due to what is known as the “base effect.” With the economy effectively shut down one year ago, prices were down across the board last April. However, over the next few months, annual changes in CPI will be calculated using less depressed base price levels than April 2020. This is largely what the U.S Federal Reserve has been arguing—that the increase in inflation is mostly “transitory.”

“These base effects will contribute about 1 percentage point to headline inflation, and about 7/10th of a percentage point to core inflation in April and May. So, significant increases…they’ll disappear over the following months and they’ll be transitory.”

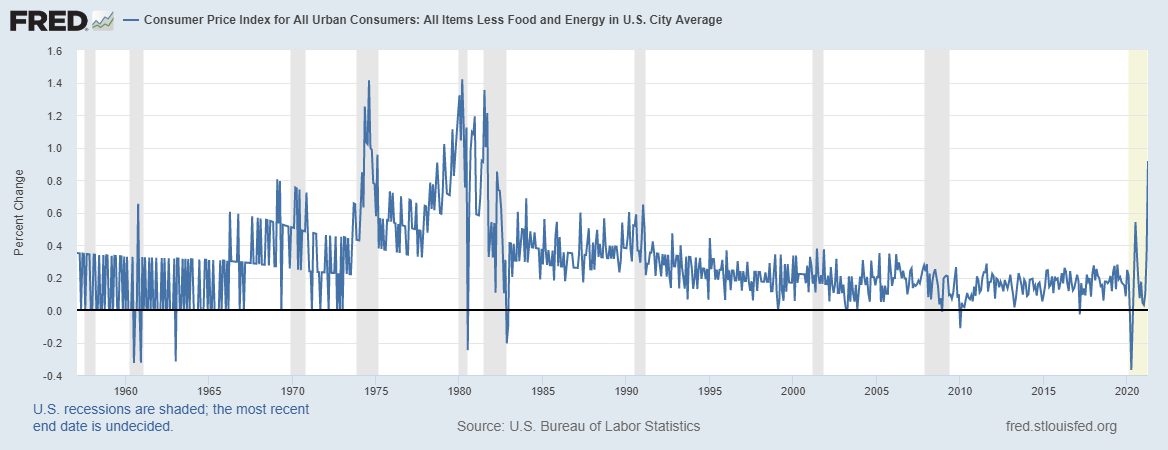

-Fed Chairman Jerome Powell

Yet, many are pointing to the month-over-month changes as the bigger concern. The monthly gain in core CPI was the largest increase since April 1982, and far exceeded expectations. Rising 10% in April, prices on used cars and trucks sales accounted for one-third of core CPI’s increase; this was actually the largest one-month increase in the used cars and trucks category since the data started being tracked….in 1953! Meanwhile, lodging prices (i.e., hotels and motels) increased 7.6%, airline fares rose 10.2% and car rental prices surged 16.2%.[i]

Core CPI – Monthly Change

Is April’s inflation transitory or sustainable?

Whether recent inflation data is being fueled by monetary stimulus, fiscal stimulus, or improving economic conditions (it’s probably all three), the pressing question is whether this is simply a reflation from depressed pandemic-level prices or indicative of a longer-term trend that will soon surpass pre-COVID levels.

“…They're trying to make people not scared about inflation by calling it 'transitory.' But how do they know? How does anybody know whether it's transitory or not given the unusual circumstances that we're in?"

- Jeffrey Gundlach

These spikes in inflation, even if transitory, have an immediate influence on our decisions. While the Federal Reserve is trying to ease fears of surging prices, it’s impossible to predict how high, or how long, such inflationary periods may be. Transitory or not, price increases have direct, real world impact. We’ve heard plenty of stories from clients looking forward to summer vacation but are now having to deal with higher-priced car rentals and hotel rooms or having to pay more for that airline ticket. But those same clients also wonder how inflation will impact their investment portfolio. To answer that, it’s important to evaluate realized inflation (i.e., CPI) relative to inflation expectations. April’s CPI figures were unexpected, but inflation expectations are also increasing quite noticeably.

Inflation Expectations as Measured by Breakeven Inflation Rates

Realized inflation and inflation expectations are intrinsically linked; when the two measures move in lockstep, that usually benefits stocks. If consumers expect inflation to be X%, companies are more than happy to realize those expectations via higher-cost goods and services. That is, until consumers are no longer willing and/or able to pay for it. So, keep an eye on wage growth. As the economy has begun to fully reopen, there has been a growing gap between labor supply and demand. There are many ideological explanations behind why, but it will be important, at least from an inflation perspective, to see if businesses start increasing wages to hire needed workers.

Total Nonfarm Job Openings Hitting Record Levels

All-Weather Core: Expect the Unexpected

April’s CPI numbers showed us that unexpected inflation may be coming sooner rather than later. Risk-parity strategies, like our All-Weather Core portfolio, are intended to capture returns in all types of economic environments, whether inflationary, deflationary, or disinflationary. Importantly, it seeks to hedge against unexpected inflation by allocating roughly one-third of the portfolio’s risk allocation to assets that have historically performed well in such conditions (for more on that, please read The Imperfect Hedge, Without Wax). This is where traditional balanced portfolios based on Modern Portfolio Theory often fall woefully short…and why we believe our clients may not have to worry as much about inflation’s impact on their portfolio. The goal of the All-Weather Core portfolio is to have them already prepared.

As always, if you have any questions, or would like to learn more about how SineCera Capital helps clients manage their wealth as a fiduciary, please do not hesitate to contact us.

Best Regards,

Adam J. Packer, CFA®, CAIA®

Chief Analyst | SineCera Capital

Disclaimer: The information provided is for educational purposes only. The views expressed here are those of the author and may not represent the views of SineCera Capital. Neither SineCera Capital nor the author makes any warranty or representation as to the accuracy, completeness or reliability of this information. Please be advised that this content may contain errors, is subject to revision at all times, and should not be relied upon for any purpose. Under no circumstances shall SineCera Capital be liable to you or anyone else for damage stemming from the use or misuse of this information.