Uneasy Lies the Head – When Cash is King

I think it’s fair to say that for many asset managers, the most difficult time to raise capital, let alone invest, is when “cash is king.” With a recession forever lurking on the horizon like some perverse oasis, many investors feel justified parking their well-earned capital in money market funds and/or bank deposits. Others, who may or may not have the same negative outlook for stocks, still think cash is the best option because the U.S. central bank (a.k.a. the “Fed”) may not be done raising their target short-term interest rate. To some, the current 5.25-5.50% target may not be sufficient to slow down the economy and bring down inflation to the Fed’s (somewhat) arbitrary target of 2% “on average.” It is also fair to say that the Fed has tapered its hawkish policy shift, but that may not be much relief given the current rate was achieved by going at the equivalent acceleration of a Tesla’s Ludicrous Mode. Still, “higher for longer” remains the topic du jour when discussing Fed policy. But how much higher? And how much longer? As many risk assets are priced by accounting for such future expectations, how can we be certain that cash won’t remain king for the foreseeable future?

It’s a difficult, albeit necessary, conversation to have with clients who are currently sitting in the “safety” of cash. But is this the right approach for those waiting for the stock market to correct or for those waiting for the Fed to reign in interest rates?

Hat tip to Vanguard for doing an excellent job summarizing why bonds, relative to cash, may make sense both as a recession resilient asset and as a long-term investment holding.

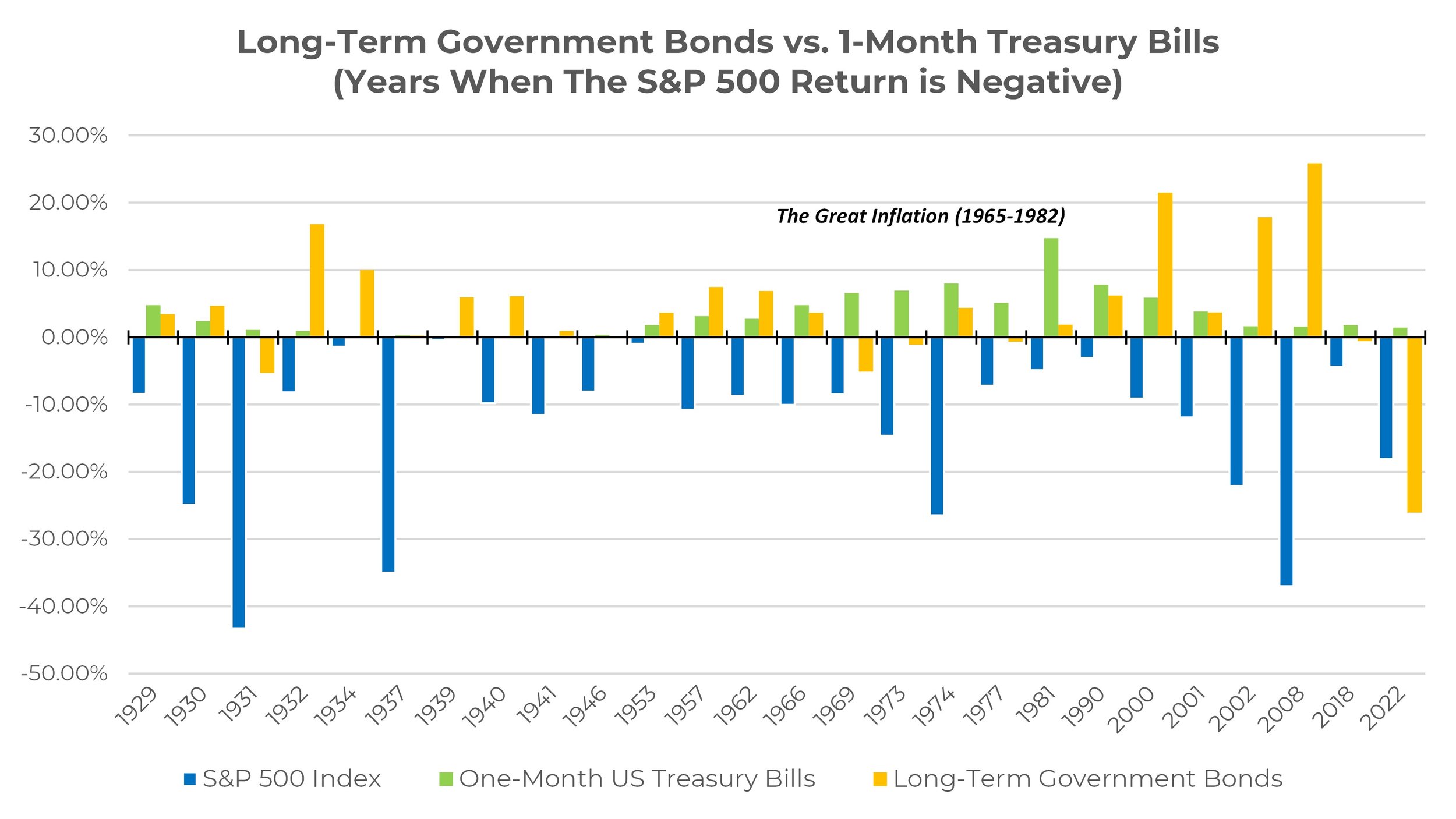

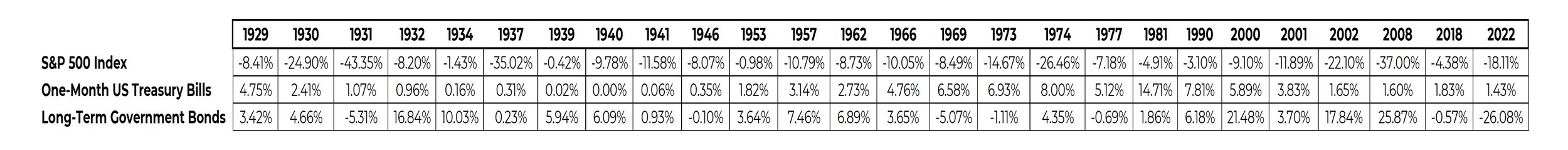

We agree with Vanguard’s thesis that bonds are a good portfolio investment. 2022’s performance, where stocks and bonds both fell significantly, was an “exception not the rule.”Bonds, particularly U.S. government bonds, have historically delivered strong results in years where equities are negative and during recessionary periods. Bonds also usually outperform cash, except in periods that experience rapidly rising interest rates, like 2022 or during the Great Inflation period from 1965-1982 (note: even though cash outperformed long-term government bonds in the 1970s, bonds still provided a positive nominal return). With multiple measures (e.g., CPI, PPI, PCE) showing signs that inflation appears to be leveling off, we don’t believe rates need to rise further to put additional downward pressure on the economy.

Note: One-Month Treasury Bills used as a substitute for money market funds given length of available data. The average maturity of a money market fund typically ranges from 30–60 days.

Further, using current yields as a starting point, longer duration bonds have more upside potential (if the Fed lowers rates) than downside risk (if the Fed continues raising rates). Over the past 40 years, as the Vanguard article also highlights, every 3-year period following the conclusion of a Fed tightening cycle has resulted in significant outperformance of bonds versus cash.

So, if cash isn’t king, or soon to be deposed, what’s the next step? As we often say, SineCera Capital doesn’t take a one-size-fits-all approach to portfolio construction. Neither should any financial advisor. Determining the right balance between stocks (risk assets) and bonds (less risky assets) is dependent upon a wide range of factors that are client specific. Cash may very well still be a good option for a portion of a client’s assets, specifically if their investment horizon is very short (i.e., less than a year) and they have a near-term need for that capital.

We believe our “All-Weather” strategy sticks out amongst the competition because of conviction in pursuing uncorrelated returns and the value in reducing equity risk with long-term Treasuries. For the contrarians out there, we would be honored to have a conversation on how we can help diversify your portfolio with our risk-balanced approach.

Best Regards,

Adam J. Packer, CFA®, CAIA®

Chief Investment Officer | SineCera Capital