The Illiquidity Premium Problem

We’re talking about illiquidity wrong…at least lately [Why the Illiquidity Premium Is a Bad Reason to Invest in PE].

Recent arguments have sought to refute the idea that private market investments (e.g., a private equity fund) warrant higher returns because these funds lock up capital for prolonged periods, typically 10+ years. In other words, investors have been expecting higher returns to compensate for their inability to easily sell that investment.

As the above article notes, restricting the ability to sell an investment does not automatically guarantee a higher investment return. While I agree, I think that misses the point.

The illiquidity premium has nothing to do with holding period. The illiquidity premium in private markets appears to be shrinking (or non-existent to some) due to the amount of capital flowing into these asset classes. Lately, there’s no lack of liquidity in the private markets at all!

“Returns on capital are highest where capital is scarce.”

-Richard Bernstein

Higher potential returns exist in areas where capital is less abundant. Returns are also influenced by the relative flow of capital. If you’re a buyer, when liquidity is low, you’ll have better negotiating power because there’s less competition. But, as a seller, the last thing you want is a market that has remained illiquid. When an investor goes to sell an asset, they want to see as many potential buyers as possible to secure the best possible deal. As Warren Buffett said, “be “fearful [i.e., sell] when others are greedy, and greedy [i.e., buy] when others are fearful.” THAT is how you capture the illiquidity premium.

Private markets are flush with cash

Historically, the illiquidity premium has existed because private asset classes (e.g., private equity, venture capital, real estate, etc.) were restricted to institutional investors and attracted less capital. Yet, over the years, institutional investors have been upping their investments in private markets, with an average allocation of 18.5% as of 2020, up roughly five percentage points since 2012.[i] Further, the so-called “democratization” of private investments has opened the floodgates to retail investors who are now able to gain access via feeder funds and lower investment minimums.

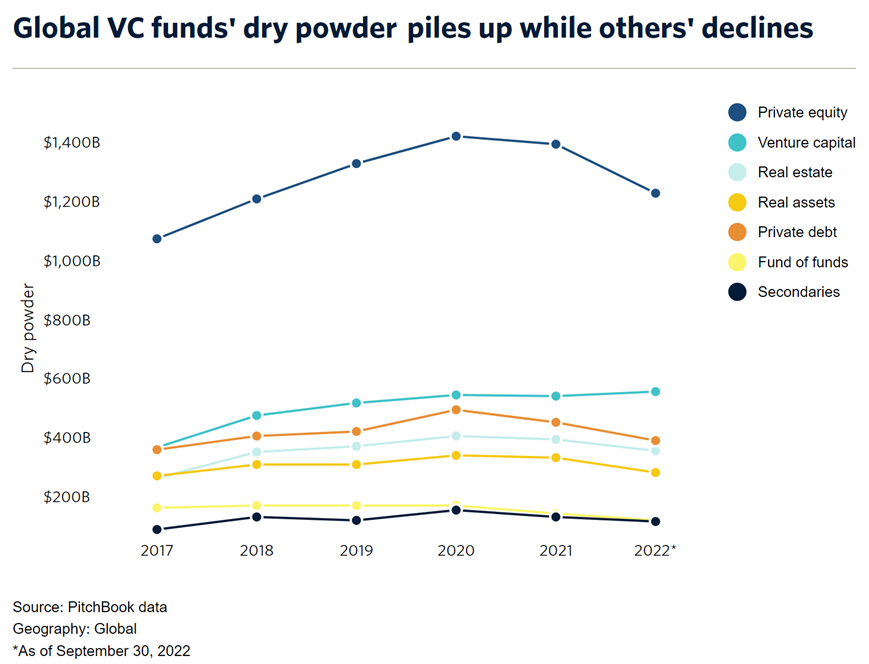

The good news is that the total amount of capital waiting to be invested (a.k.a. “dry powder”) has begun to wane, declining from a peak of ~$3.74 trillion in 2020 to just under $3.26 trillion (as of Q3 ‘22). However, not all asset classes in the private market saw similar pullbacks last year. While private equity saw a notable decline in cash reserves, venture capital’s dry powder remains at record highs, with over $585 billion globally, most of which is in the coffers of U.S. VCs. [ii] [iii] VCs have also had to compete with non-traditional investors known as “crossover investors” such as hedge funds, mutual funds, and corporate venture capitalist (or, CVCs). These market players are opportunistic investors, meaning they usually don’t have a long-term strategic allocation to private investments. They have also been a big reason why private market valuations, particularly in venture capital, have soared over the past few years. Fortunately, the amount of capital they’re deploying has begun to decline.[iv]

When Dry Powder is High & Top-Heavy, Swim Upstream

So how should we approach the private market, when it appears that so many investors have already allocated into these asset classes, with excess capital ready to deploy over the next few years?

Digging deeper into these investment categories reveals the locked-up liquidity is very top heavy, with capital flowing to the largest firms writing the largest checks. From the charts below, large investment firms (those with funds larger than $1 billion) are raising the most private capital, while most firms operate with far less.

According to Preqin, dry powder as a percentage of assets under management actually decreased last year, which seems counterintuitive given the record level of capital raised. Yet this is occurring because many of the investments made have been for deals requiring larger check sizes and higher valuations. In short, valuations have been rising faster than cash inflows.[v] Fortunately, this leaves the door open for smaller firms to invest upstream where the large investment managers simply can’t operate.

Large firms don’t often write smaller checks and build portfolios overpopulated with small companies. The math just doesn’t work, and research has noted that increasing the number investments hinders the ability to add/unlock value and generate strong performance (too many kitchens, not enough cooks).[vi] [vii] The period of idolizing the Tiger Global spray and pray model has come and gone.

However, hiring managers with less capital to deploy is risky. These managers will seek to invest in younger and/or smaller companies which may have higher upside potential but also greater downside risk. Ditto if their portfolio is more concentrated.

Further, experience becomes even more crucial in environments such as the one we’re in now. During periods of increasing capital flows and competition, experienced funds have historically performed better than newer entrants into the space.[viii] Over these past few years, new funds may have been able to ride the wave of exuberance and raise lots of capital, but now that the easy money spigots are off, the true test will be if they can source deals and add value.

This is a challenging situation. Unsurprisingly, the majority of opportunities we see are in asset classes with increasing capital inflows. Fortunately, our strict due diligence process means most deals du jour don’t reach our clients. While there may be a few gems in the latest pile of pitches, it’s important to be especially discerning in today’s environment. After all, we may no longer be able to rely on the illiquidity premium to carry us through, no matter how long we hold onto that private investment.

Best Regards,

Adam J. Packer, CFA®, CAIA®

Chief Investment Officer | SineCera Capital

[i] Private Markets Rally to New Heights, McKinsey & Company, March 2022

[ii] https://pitchbook.com/news/articles/venture-capital-dry-powder-2022

[iii] Q4 2022 PitchBook-NVCA Venture Monitor (Data, as of September 30, 2022)

[iv] Q4 2022 PitchBook-NVCA Venture Monitor (Data, as of September 30, 2022)

[v] https://www.preqin.com/insights/research/blogs/dry-powder-attempts-to-keep-up-with-pricey-deal-markets

[vi] Giants at the gate: Investment returns and diseconomies of scale in private equity, Florencio Lopez-de-Silanes, Ludovic Phalippou, and Oliver Gottschalg, August 2, 2013

[vii] https://pulse.moonfire.com/972-billion-portfolios-how-to-design-the-optimal-venture-portfolio/

[viii] Private Equity Performance: Returns Persistence and Capital, Steven Kaplan and Antoinette Schoar, June 2003